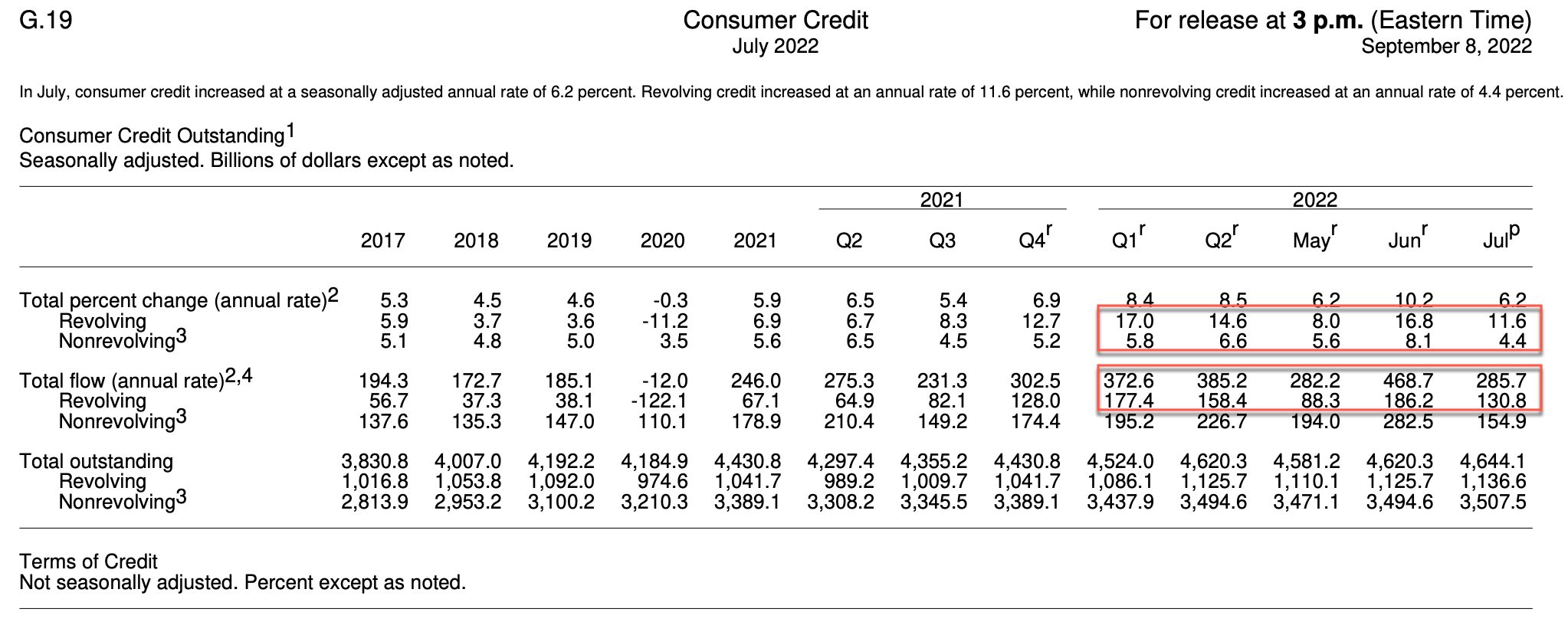

Today’s Federal Reserve Consumer Credit Report (G.19) reported the following for July:

Consumer credit increased at a seasonally adjusted annual rate of 6.2 percent. Revolving credit increased at an annual rate of 11.6 percent, while nonrevolving credit increased at an annual rate of 4.4 percent.

This reflects a month-over-month decrease in revolving credit from 16.8 billion to 11.6. See the full G.19 report here.

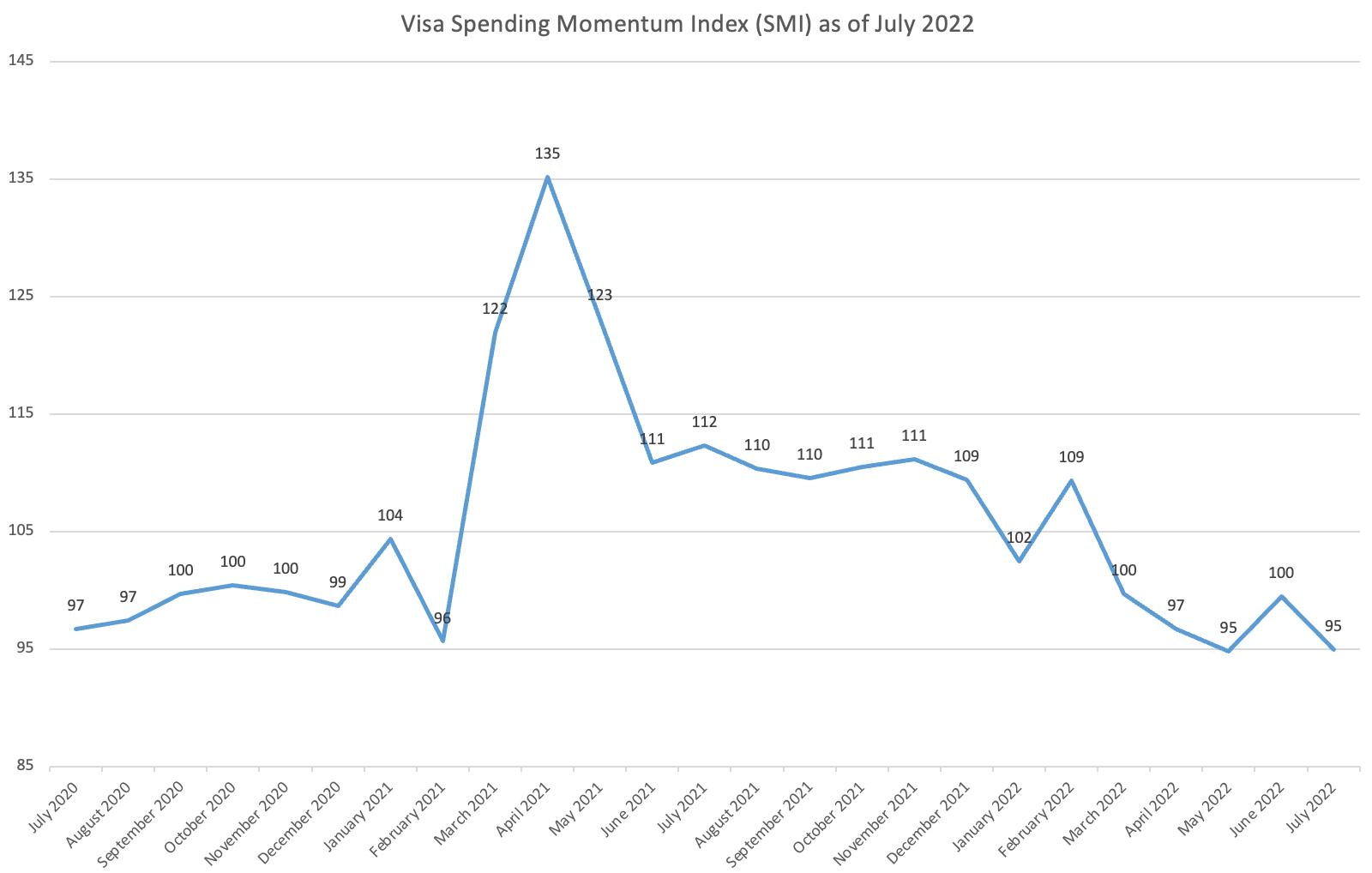

Directionally this is consistent with the most recent Visa Spending Momentum Index (SMI) which reported the following (Aug. 11):

Visa’s U.S. Spending Momentum Index (SMI) declined to 95.0 in July (seasonally adjusted), a 4.5-point deterioration from June. The SMI has now recorded a month-over-month (MoM) decline in five out of seven months in 2022 and the trend is clear: Most consumers are spending less via payment methods. All major components of the SMI declined in July—the indexes for discretionary and non-discretionary spending are both firmly below 100—indicating that spending activity is becoming concentrated among a smaller share of consumers.